Whatcom County School District Measures

Lynden SD

Link to the interactive calculator

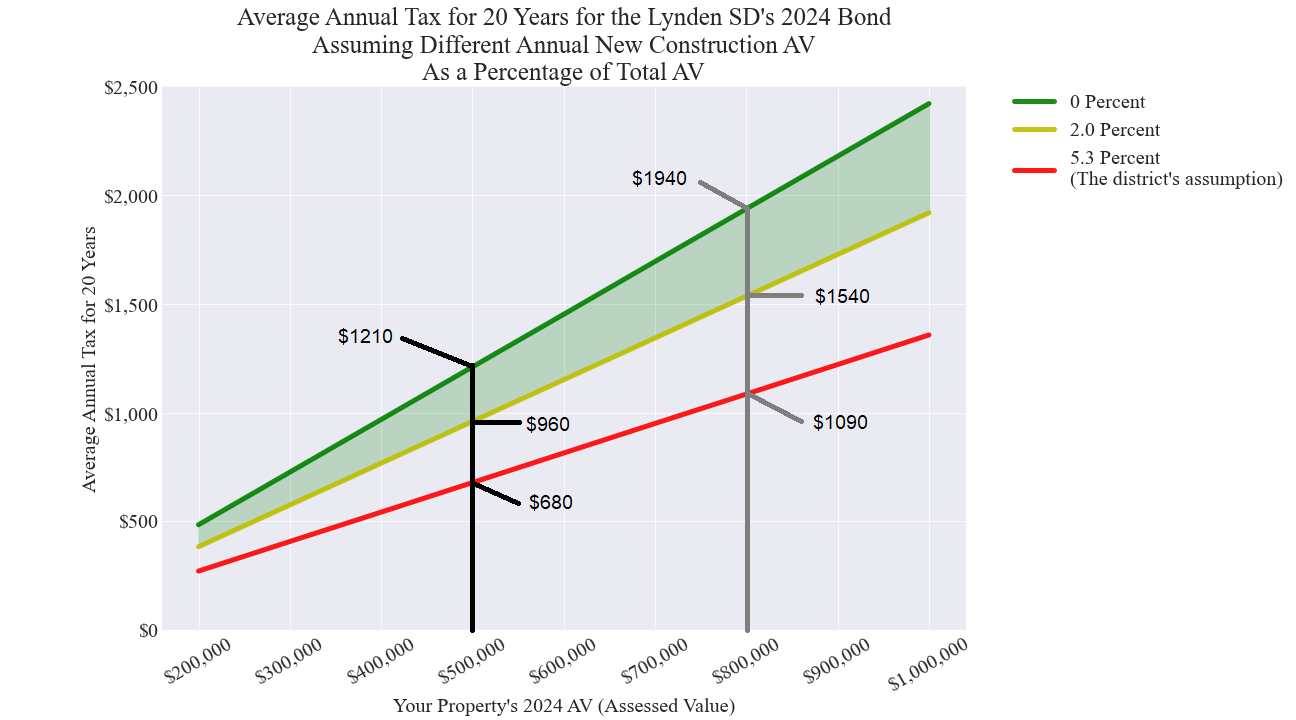

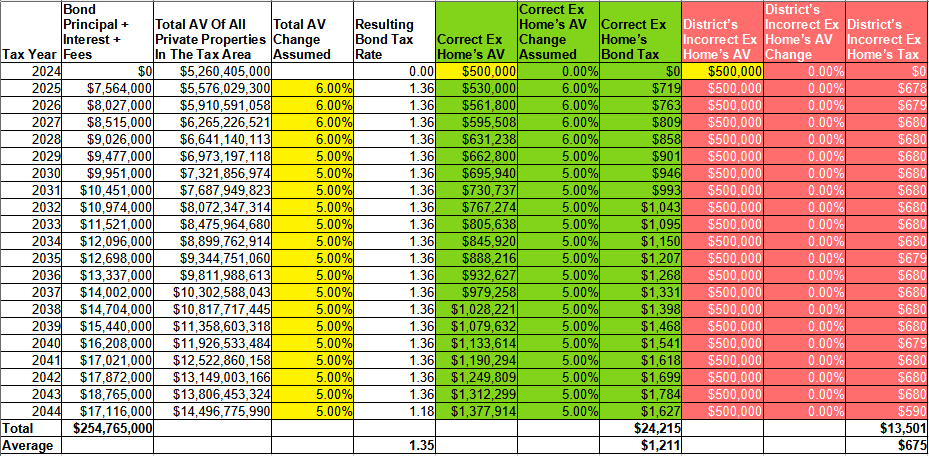

Since the district designed an escalating bond repayment schedule, average annual costs are used in this next chart for the bond taxes for the 2024 bond for local taxpayers. The worst case scenario for taxpayers is usually the assumption of zero new construction. Another scenario to consider is continued new construction (despite high interest rates) for each of the next 20 years at about the same pace as 2024. That is about 2.0% of Total AV (also called the Total Tax Base). The district, in their campaign materials, is, effectively, using a value of 5.3% of Total AV for new construction in each of the next 20 years. That 5.3% value of Total AV is more than 2 1/2 times the actual new construction activity for 2024.

To use this chart, start at the x-axis at the value of your property’s 2024 AV - say for example $500,000

If we assume zero new construction for each of the next 20 years, the owner of that property would on average pay just over $1200 per year.

If we assume new construction continues each year at the pace of about 2.0% of Total AV each year, then the owner would pay about $960 per year on average.

The district is assuming 5.3% for new construction as a percentage of Total AV. That is how they came up with their advertised $680 per year for the property owner for the example property with a 2024 AV of $500,000.

The case for a property with a 2024 Tax Year AV of $800,000 is also highlighted.

The district’s property tax cost impact analysis (from the district’s website) is shown in the next image with the red border.

The district’s cost analysis earns an “F” using the described rubric.

Link to the detailed report of the analysis of each district’s cost impact analysis

Instead of $680 as a cost for this 1 bond, the district should have calculated an average annual cost of over $1200!

The district’s cost estimate is over 75% too low.

An average was necessary since the district designed their bond payments schedule to be unlike a home mortgage.

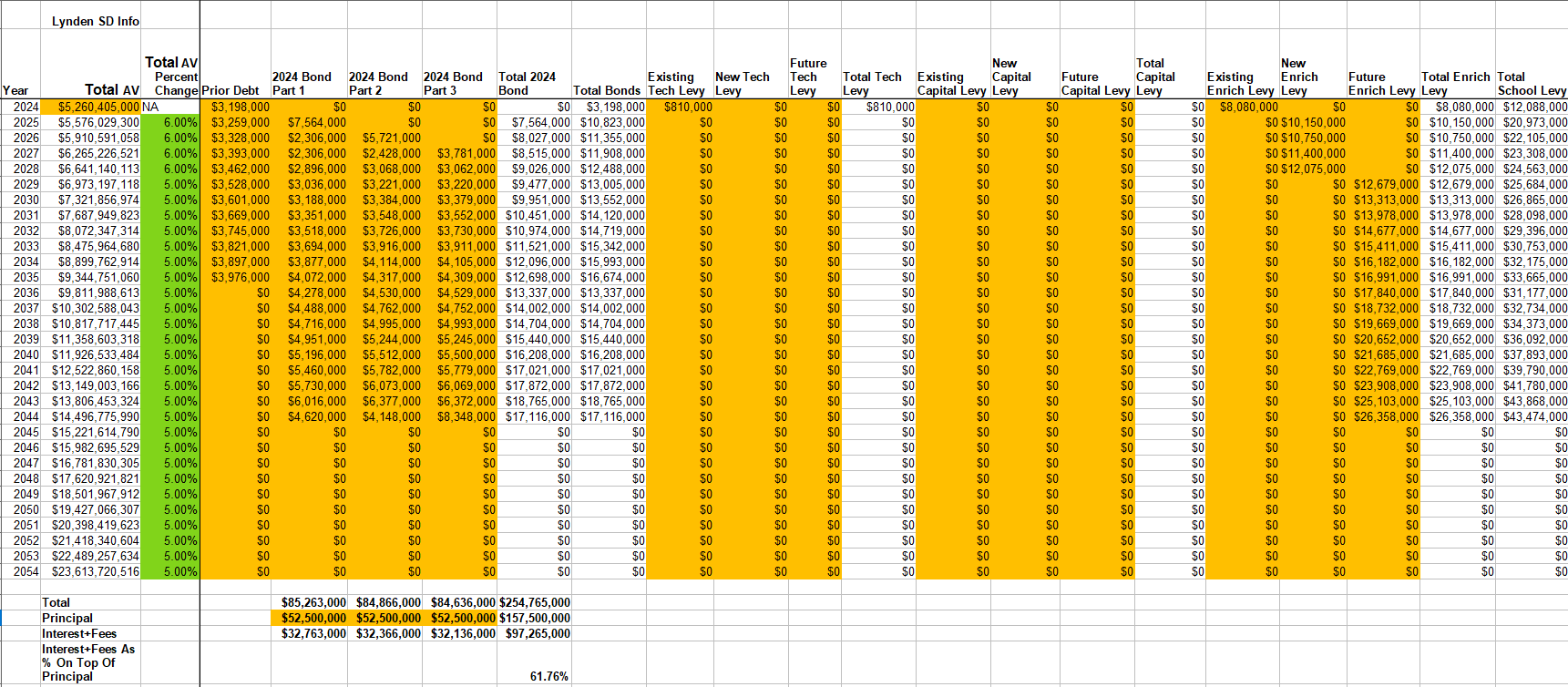

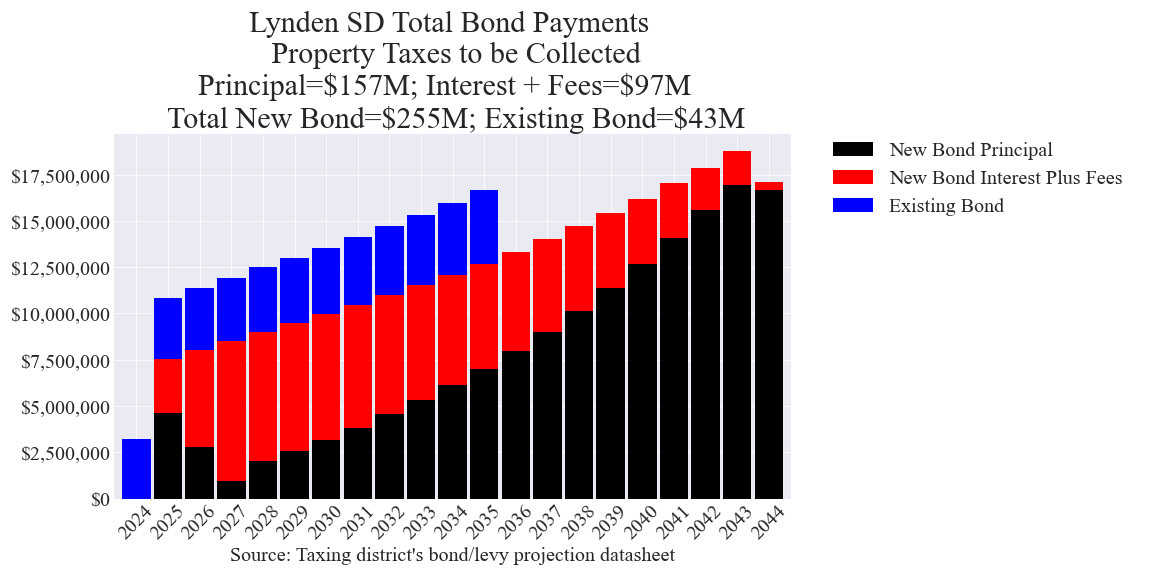

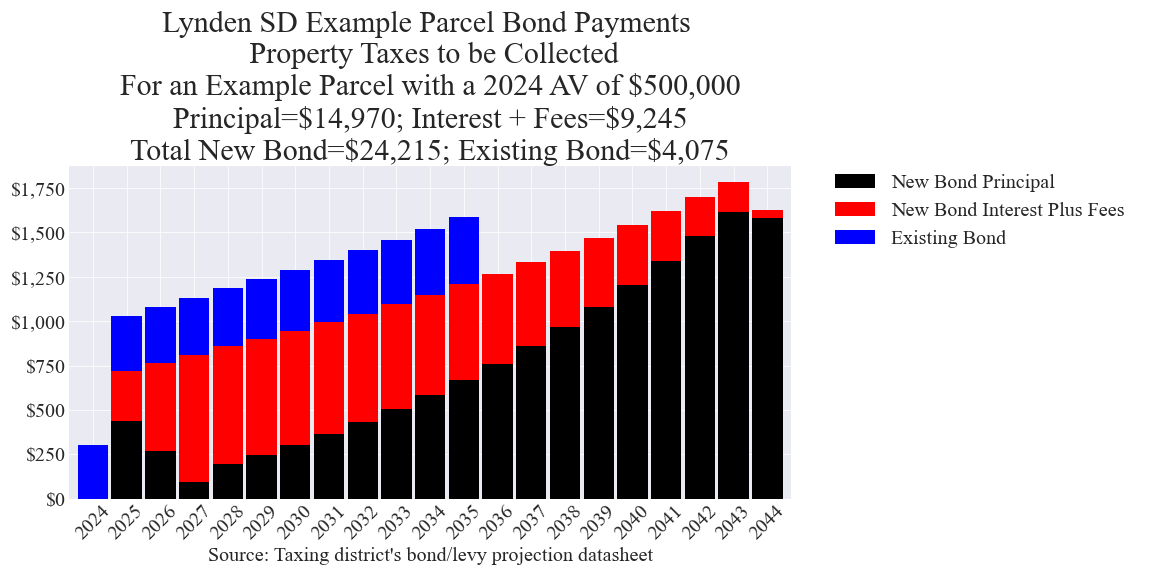

The district designed their bond payments (taxes to collect each year) starting out at an already high value and then increasing each year at 5 to 6% compounded annually.

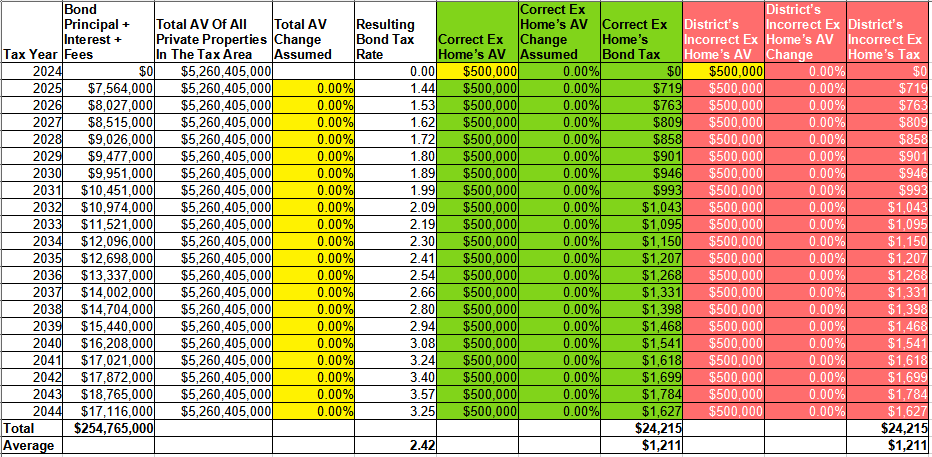

For the owner of the property with a 2024 AV (assessed value) of $500,000, the tax for this 1 bond would be $719 in 2025 and then rising to over $1700 in 2043!

The district is making a common, logic and math error. The district is assuming 6% increases each year (compounded) in Total AV from 2024 to 2028. Then the district is assuming 5% increases each year (compounded) from 2029 through 2044. The district should have allowed their example property’s AV to also increase at the same pace as their assumption for Total AV. The author has also shown (using basic Algebra) that the district and all districts do not need to guess future Total AV to try to then guess future tax rates.

Only a few districts in WA such as Yelm and Tacoma correctly calculate the cost impact for example properties for their tax measures by letting the AV of the example properties rise and fall at the same pace as their assumptions for Total AV changes. The Lynden SD reps should contact one of those districts for advice.

The district failed to voluntarily follow the Truth In Lending Act (TILA) guidelines. The district should always provide the following in all of their campaign materials:

- Total bond principal - in dollars. ($157.5M)

- Total bond estimated interest and fees - in dollars. ($97M)

- Total cost to taxpayers (total bond principal + total bond interest and fees) - in dollars. ($254.5M)

- Bond maturity length - in years. (20 years)

- Bond schedule showing the tax amounts in dollars to be collected each year. A few districts such as Paterson and Bellevue designed their bond payments schedules to be similar to a home mortgage with constant payments each year. The Lynden SD however designed their bond schedule to have escalating payments each year as shown in the charts above.

- Total existing bond debt payments - in dollars - for the current year through the final year of the remaining term for the existing debt. ($43M still in total payments to make. Last payment will be in 2035)

- An online calculator that uses a conservative estimate and uses sound accounting principles to estimate the cost impact each year of the term of the new bond for each taxable property if the bond passes and if it doesn’t. All property tax categories need to be shown: proposed new bond principal, proposed new bond interest plus fees, existing bond, enrichment levies, capital levies, State School taxes, and non-school taxes.

The district only provided items 1 and 4.

This next table shows how the district is assuming certain large Total AV changes each year but it is (nonsensically) keeping the AV of the example property constant at $500,000 for each of the next 20 years.

The district is incorrectly just multiplying the fictitious rate of 1.36 by the example home’s constant AV.

1.36 X $500,000 / 1,000 = $680

See the additional Lynden SD example bond calculator to demonstrate how future guesstimated tax rates are meaningless:

Link to the interactive calculator version 2 for the Lynden SD bond

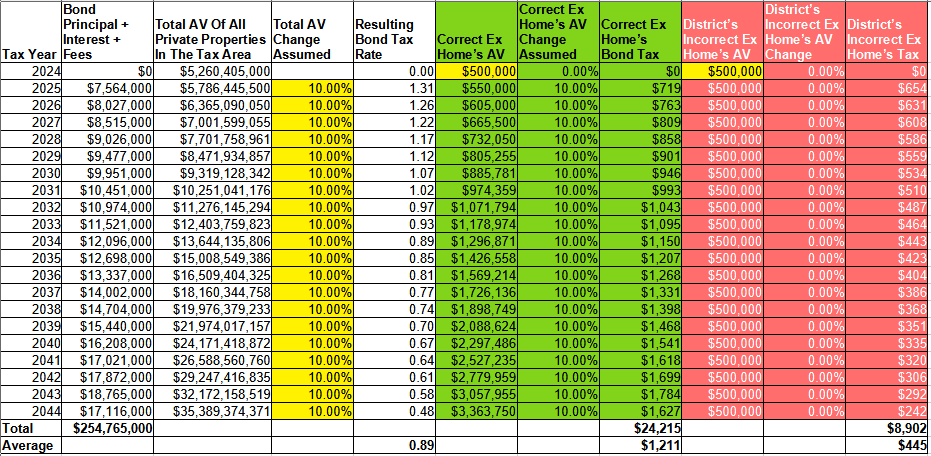

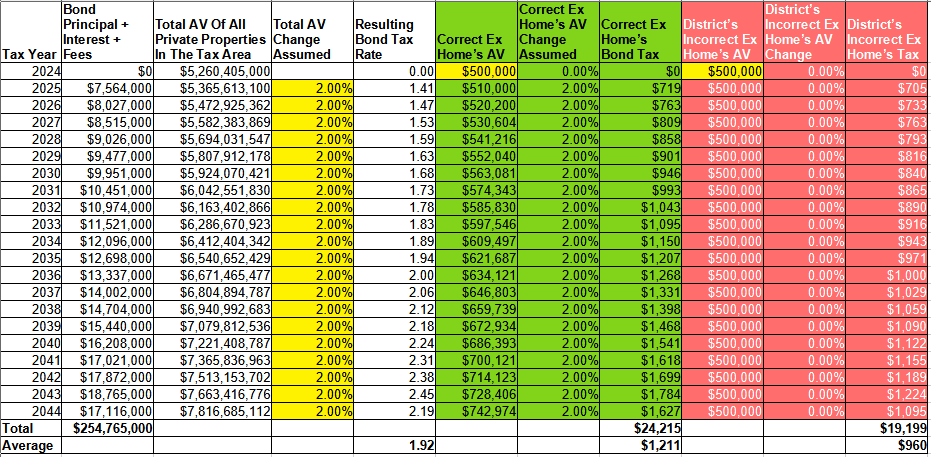

Future guesstimated rates can be designed to be almost anything. Assume a lower Total AV, then the calculated rate will be higher. Assume a higher Total AV, then the calculated rate will be lower. But the amount of tax to collect will be the same.

The county assessor and only the county assessor calculates the actual rate each January of each year.

{Rate for a given year} = {Bond payment for the given year} / {Total AV for the given year} X 1,000

The district came up with a 1.36 rate because of their assumption of 5-6% for Total AV growth each year for the next 20 years. If they had used a 10% growth, the average calculated future tax rate would have been 0.89

Then the district would have incorrectly calculated:

0.89 X $500,000 / 1,000 = $445

If they had used 2% growth, the average fictitious calculated future tax rate would have then been 1.92

Then the district would have incorrectly calculated:

1.92 X $500,000 / 1,000 = $960

But in each case, the homeowner of the example property would still actually owe $1200 on average each year for the next 20 years as the tables show. And that is the point. Future guesstimated rates should be prohibited from all district campaign materials. Citizens are not voting on future rates. They are voting on amounts in dollars.

In fact the district could have just assumed 0% growth in Total AV for each of the 20 years of the bond. The rates that are then generated are basically based on the base year (2024 in this case) that we know the Total AV for. So there would be no guessing. The tax rates calculated would all be escalating. That is because the district designed their bond repayment schedule to be escalating. But then voters/taxpayers could easily and accurately calculate their tax for this one bond for each of the next 20 years.

Source: Lynden SD’s bond/levy projection datasheet information